Finance Charges |

Top Previous Next |

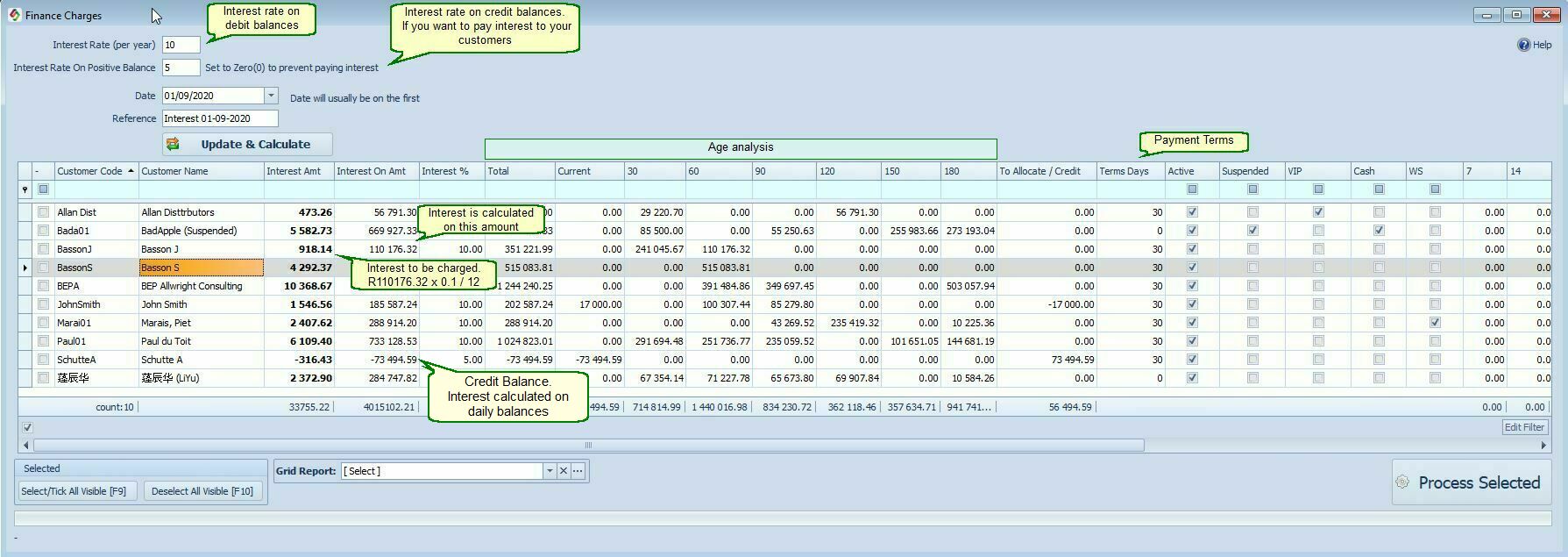

Finance charges for late payments or paying interest on positive balances.

Go to Customer > Interest Calculation. Below is a list of customers who will pay interest.

Hover the mouse over the different fields on the form. If the cursor changes to a hand (![]() ) , click to get more information.

) , click to get more information.

To Allocate Column:

Amounts shown in this column mean that there are still payments/credits that must be allocated to the invoices/debits.

See Customer > Enquiries.

Example of how the interest is calculated.

E.g. say the date is July (July is the current month) and the payment terms is 30 days.

Thus, May and April are already overdue and June is payable on or before 31st of July

Total |

Current (e.g. July) |

30 Days (e.g June) |

60 Days (e.g May) |

90 days (e.g April) |

1300 |

100 |

500 |

300 |

400 |

If you put in the date as 1 August on the interest form, then SI+ will calculate the interest on 1200 (June + May + April)

If you used a date in July the interest would be calculated on R700 (May + April)

Thus, usually the date will be on the first of the month.

After processing you can go to Ledger > GL Details to see the total interest amount that was charged. To see the individual interest amounts that were charged for each customer, go to Customer > Customer Detail. Type in Interest in the search row's Reference box.

To reverse the interest posted.

Go to Customer > Customer Journals.

Select 'Adjustment' and 'Completed'

In the blue search row, in the description box, type in Interest to get a list of interest charges.

Double click the journal you want to reverse.

The journal will now open. Click on the 'Reverse' button to reverse the entries.

Notes.

The default contra interest account can be set in Ledger > Account Options > Account Defaults Tab.

See also Payment Due Date and Payment Terms