New Payment Run |

Top Previous Next |

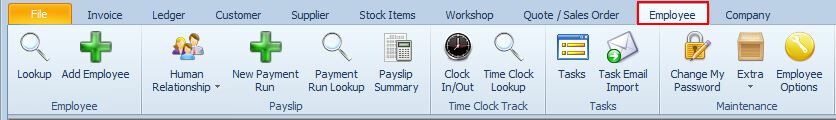

Go to Employee > New Payment Run to process your salaries.

Hover the mouse over the different menu options. If the cursor changes to a hand (![]() ), then click to go to the subject.

), then click to go to the subject.

![]()

![]()

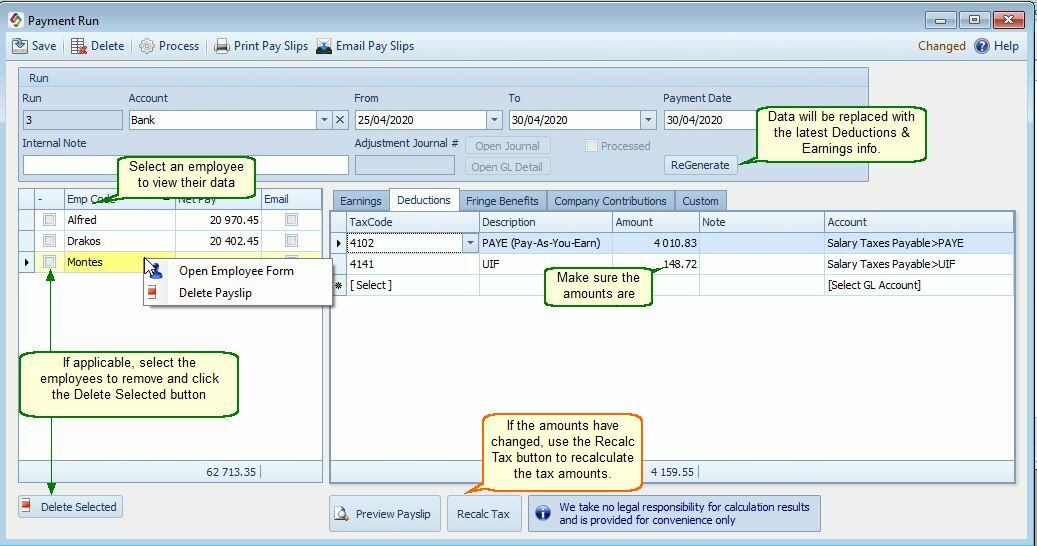

If everything is correct, select the Process button.

The following journal entries will be made.

Ledger Account |

Debit |

Credit |

Notes |

Salaries>Drakos |

20402.45 |

|

Earnings - Cost to company. |

Salary Taxes Payable>PAYE |

|

4010.83 |

Amount that must be paid to the government. |

Salary Taxes Payable>UIF |

|

148.72 |

Amount that must be paid to the government. |

Salaries>UIF Company Contributions |

148.72 |

|

Employers expense. The general ledger account used is the account you set up in the Ledger > Account Options > Account Defaults tab |

Salary Taxes Payable>UIF |

|

148.72 |

Amount that must be paid to the government |

Bank |

|

24052.45 |

Amount that must be paid to the employee. Click on the Account field to change the account. |

Use the 'Recalc Tax' button to recalculate amounts if the amounts have been changed or added.

If the amounts have changed, use the Recalc Tax button to recalculate the tax amounts.

To look-up previous payments - go to Employee > Payment Run Lookup

To see a summary of the salaries - go to Employee > Payslip Summary

.