General Ledger: Account Options |

Top Previous Next |

Go to Ledger > Account Options

![]()

![]()

General Ledger Account Options

Navigate to: Ledger > Account Options

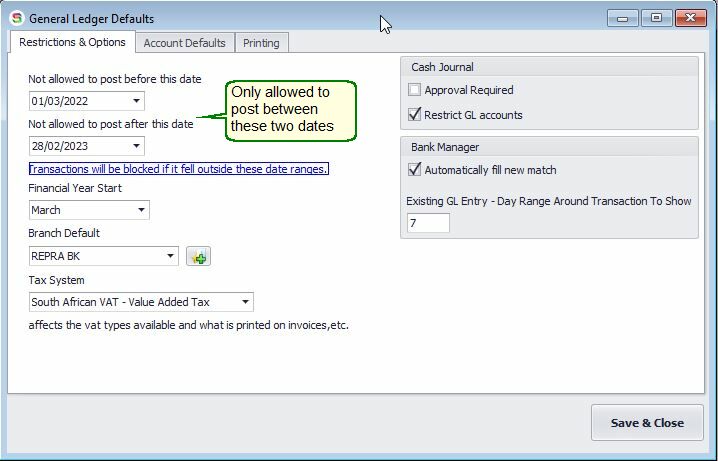

General Ledger Defaults - Restrictions & Options

General Ledger Defaults - Restrictions & Options

General Ledger Defaults - Restrictions & Options

In the General Ledger Options, you can apply restrictions to limit the dates on which users are allowed to post transactions. Transactions will be blocked if it fell outside these date ranges.

Navigate to: Ledger > Account Options

![]() Posting Date Limits

Posting Date Limits

In the General Ledger Options, you can set restrictions to control the dates on which users are allowed to post transactions. Any transaction falling outside these ranges will be blocked.

•Not allowed to post before this date

Prevents users from entering transactions dated before the specified date.

Use this to block backdated entries.

•Not allowed to post after this date

Prevents users from entering transactions dated after the specified date.

Set future periods to remain locked until manually opened.

How to fix the “Not allowed to post after this date” error

If you receive a “Not allowed to post after (or before) this date” error when creating an invoice or posting journals, it means the invoice or journal date falls outside the allowed posting range.

To resolve the issue:

1. Go to Ledger > Account Options

2. Locate Not allowed to post after this date

3. Update the date to include the invoice date

or clear the date restriction if future posting is allowed

4. Save the changes

5. Re-open the invoice or journal and post again

![]() Note: Only users with the correct permissions should adjust posting date limits.

Note: Only users with the correct permissions should adjust posting date limits.

✅ Use case: Ensures financial entries remain within an approved accounting period.

Default Branch Selection

•Assign a Default Branch.

•To add or edit branches, go to: Company Add or Edit Branches

✅ Use case: Essential for multi-branch businesses to track and report financial data accurately.

![]() Cash Journal Restrictions:

Cash Journal Restrictions:

You can configure the system to limit which General Ledger (GL) accounts appear in the Cash Journal when making payments or deposits.

•Payments:Only expense accounts are displayed; income accounts are hidden..

•Deposits: Only income accounts are displayed; expense accounts are hidden.

•Always Visible: Asset, liability, and equity accounts.

✅ Use case: Avoids incorrect account use during cash journal entries.

![]() Financial Year Start

Financial Year Start

The Financial Year Start setting is used in:

•The Dashboard to calculate Year-To-Date figures.

•The Budget Module for financial planning and reporting.

Bank Manager Settings

Bank Manager Settings

Automatically Fill New Match

Enable Automatically Fill New Matches to auto-reconcile bank transactions based on previous matching patterns.

GL Entry Matching Day Range:

Define the date range around the bank transaction date for matching GL entries.

•Example: If the range is set to 3 days, a bank transaction dated 17/12/2025 will match GL entries dated between 14–20/12/2025.

✅ Use case: Improves reconciliation accuracy even when transaction dates differ slightly.

Existing GL Entry - Amount Difference Display.

Shows the difference between the amount in the GL entry and the corresponding bank statement amount.

Reference: For detailed instructions, see Troubleshooting Incorrect Bank / Journal Entries in the Bank Manager module.

![]() See also: Bank Manager module.

See also: Bank Manager module.