Stock > Stock Take: Regular |

Top Previous Next |

Stock Take - Regular Stock Take

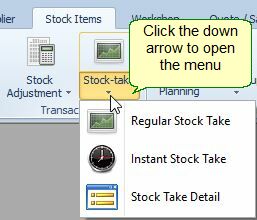

1. Navigate to Stock Items > Stock Take > Regular Stock Take

2. Alternatively, initiate a stock take from the Extended Item Lookup Form.

Overview

Stock takes can be conducted:

•Annually: Perform a full inventory count.

•Continuously: Use a cycle count system for ongoing inventory checks.

Note: Inventory is not frozen during a stock take. Any stock movements after creating the stock take must be accounted for in the final count.

Steps to Perform a Regular Stock Take

Step 1 |

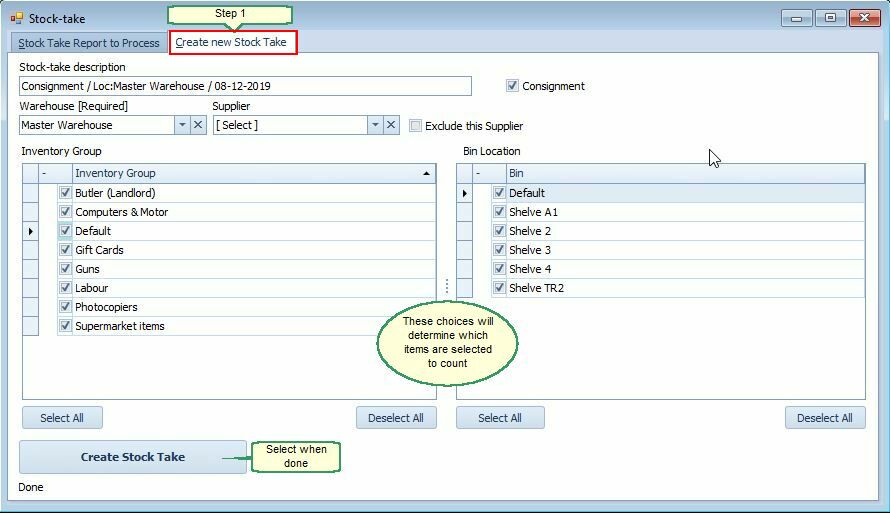

Create a New Stock Take. (see image below) SI+ will create a snapshot of the current theoretical quantities on hand.

|

Step 2 |

Select Inventory Scope Select the warehouse, inventory group, bin location and suppliers to include in the stock take.

|

Step 3 |

Generate Stock Take Click Create Stock Take to finalize the setup.

|

Step 4 |

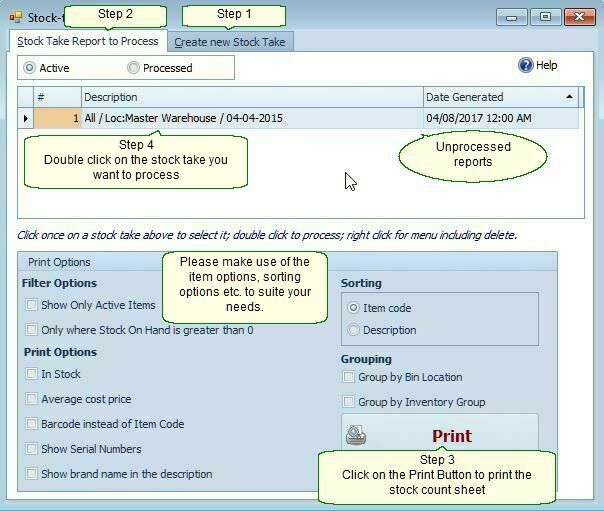

Access the Stock Take Report Navigate to the Stock Take Report to Process tab (see image below).

|

Step 5 |

Print the Stock Count Sheet Configure print options and click Print to generate the Stock Count Sheet. Recommended Print Options: •Show only active items: Excludes inactive items from the report. •Only print where stock on hand is greater than 0: Limits the list to items with existing stock.

|

Step 6 |

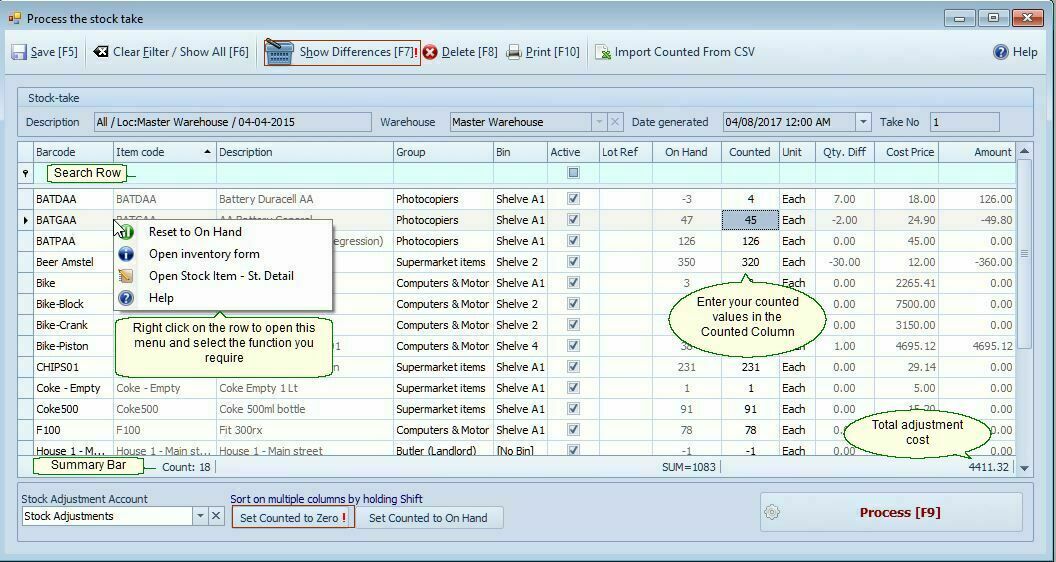

Enter or Import Counted Quantities Right-click the created stock take in the Stock Take Report and select Open Stock Take. (You will also see an option for Sectioned Stock Take Count, click here for an explanation.)

Enter physical counts manually in the Counted column, or Import counts from a CSV or Excel file.

Note: You can set the On Hand columns quantity to zero by clicking on the Set Counted to Zero. This will ensure that anything not counted will default to zero stock on hand and will appear on the variance

Tips: •To view processed stock takes, select the Processed option and double-click to open them. •For a list of adjusted items, use the Stock Detail Lookup and filter the Module column by STAKE. •To show additional columns, right-click on a header, select Column Chooser, and drag columns into the view.

Important Notes ➢ No selling should occur between printing the stock lists and completing the count.

✓ Selling can resume after counting, even if you haven’t yet processed the entries — the system uses the theoretical snapshot created at the time of stock take creation.

|

Step 7 |

Show Differences. Show the differences between the current stock on hand and what has been counted.

|

Step 8 |

Process the Stock Take Click Process to finalize the stock take and update inventory records.. |

Inventory Valuation.

To calculate the inventory value during a stock take:

•Select Cost Price and check Only where On Hand ≠ 0.

•The system displays each item’s Extended Cost (Quantity × Cost Price) and the Total Inventory Value on the last page of the report.

❖ This valuation applies only to the selected warehouse. For company-wide stock value, use the Extended Item Lookup. form.

Additional Options:

•Check Group by Stock Group to view totals per inventory group.

•Use Stock Value at Date. to access historical inventory values.

Using Stock Take for Opening Quantities.

To capture opening inventory quantities when starting inventory:

Use the Stock Take form to enter initial quantities.

Important: The Stock Take form does not allow entry of average cost prices.

•Change the General Ledger account from Stock Adjustment to Opening Balance Account.

To include average cost values:

•Use the Stock Adjustment form, or

•Import via Stock & Price List Import/Update: Go to Stock | Stock Extra | Stock & Price List Import/Update

Note: For detailed guidance, refer to the system’s documentation on Taking on Inventory Balances.

See also: Stock Value Reconciliation to check if the General Ledger stock value aligns with the physical stock value.

Additional Notes

•No Selling During Counting: Avoid selling or moving stock between printing the Stock Count Sheet and completing the physical count. Selling can resume after counting, as the system uses the theoretical snapshot from the stock take creation.

•Viewing Processed Stock Takes: Select the Processed option in the Stock Take Report, then double-click to view details.

•Tracking Adjustments: Use the Stock Detail Lookup form and filter the Module column by STAKE to list adjusted items.

•Customizing Views: Right-click a column header, select Column Chooser, and drag additional columns into the view as needed.