Non-Stock Item (NSI) |

Top Previous Next |

Non-Stock Item (NSI)

A Non-Stock Item is an item that is bought or sold without tracking its quantity in inventory.

Common uses for Non-Stock Items include:

•Reusing the same item code for different once-off items

•Selling services or goods that don’t need inventory tracking

•Internal use items purchased on a supplier invoice

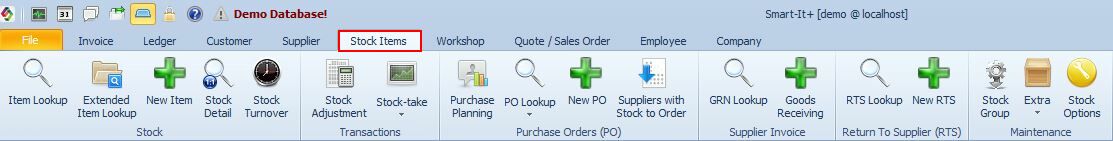

Set Up the Non-Stock Item

To set up a Non-Stock Item, you must first create or edit the item within the stock module. On the Additional Info Tab, you'll find a checkbox to mark it as a Non-Stock Item.

When this checkbox is selected, the system will not track the item's quantity in inventory. Instead, it will prompt you to manually enter the cost price whenever you use the item on a Goods Received Note (GRN), Invoice, Job Card, or Quote. This allows for the cost to be captured at the time of the transaction, which is essential for accurate profit calculations and reporting. The cost price entered is then used by the system for the Stock Turnover report and to calculate profit margins.

Processing a Goods Receive Note (GRN).

When you process a GRN for a Non-Stock Item, the following accounting entries will be made:

Debit |

Credit |

|

Cost of Sales |

x.xx |

|

Supplier Control |

|

x.xx |

Selling Non-Stock Items - Methods

Method 1: Through the Quote or Job Card Module (Recommended)

This method is preferred because you can record the cost price while creating the quotation or job card.

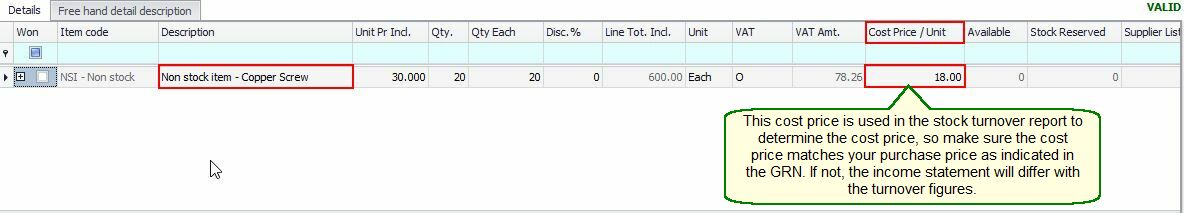

•For Non-Stock Items (NSI) items, the Cost Price column is editable.

•The system uses this cost for Stock Turnover reporting and profit calculations.

When the item is sold:

Debit |

Credit |

|

|---|---|---|

Customer Control |

x.xx |

|

Sales |

x.xx |

|

Cost of Sales |

x.xx |

|

Cost of Sales |

x.xx |

Note: These cost of sales entries cancel each other out because the cost was already recorded at the GRN stage.

Method 2: Through the POS Module

If you add an NSI item directly to a POS invoice:

•A dialog will prompt you for the cost price.

•You are responsible for providing the correct cost price.

Note:

•The cost of sales is recorded immediately when you do the GRN.

•If the invoice is only processed the following month, it may affect your financial reporting:

•Gross profit in the previous month will be lower.

•Gross profit in the current month will be higher.

This timing difference means your Stock Turnover Report might not align with the Income Statement.

Tip:Try to process the GRN and invoice in the same month to keep reporting aligned.

Cost Price Usage

The Cost Price entered on a quotation, job card, or invoice only affects the Stock Turnover Report, helping you analyze margins:

Example: Turnover: $100 - Cost Price: $20 - Profit: $80

How to process a GRN with items for sale and internal use on the same supplier invoice.

1. Create a Stock Group for Internal Use

•Go to Stock Groups and create a new group (e.g., Internal Use).

•Change the Cost Account to an appropriate GL account (e.g., Workshop Usage).

•Ensure the Workshop Usage account exists in the General Ledger.

Tip: You can also change the GL account directly on the GRN. Look for the column GL Stock Account and select the appropriate account.

Non-Stock Item Options

Go to: Stock Options > General and select your defaults