Supplier Reconciliation - Status Method |

Top Previous Next |

Hover the mouse over the different menu options. If the cursor changes to a hand (![]() ), then click to go to the subject.

), then click to go to the subject.

![]()

![]()

Why Reconcile?

Supplier statement reconciliations are one of the most important financial controls. They ensure that:

•All amounts due are correctly recorded

•No duplicate invoices or payments are processed

•Liabilities and costs are accurately reflected

Reconciliation Methods

In the Supplier Main Form, you can choose between two reconciliation methods:

•Method 1: Status Reconciliation (recommended) - Method described here.

Provides checks and balances to ensure accurate reconciliations.

•Method 2: Invoice Reconciliation

A simplified method with no checks — best for small businesses with uncomplicated supplier accounts.

Supplier (Creditor) Status Reconciliation (Recommended)

How to Reconcile.

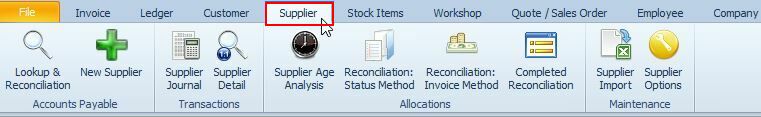

1.Go to Supplier > Lookup & Reconciliation

2.Right-click a supplier and choose Reconcile this Supplier.

3.The form will display:

•Goods Received Notes (GRNs) – Supplier invoices

•Return To Suppliers (RTS)

•Payments

Steps

Reconcile the account – match invoices (GRNs) and payments

Print Remittance Advice Note – confirm what will be paid

Process the reconciliation – finalizes entries and moves them to “Completed Reconciliation”

Complete the payment - go to Completed Reconciliation to issue the supplier payment

Hover the mouse over the different fields on the form. If the cursor changes to a hand (![]() ) , click to get more information.

) , click to get more information.

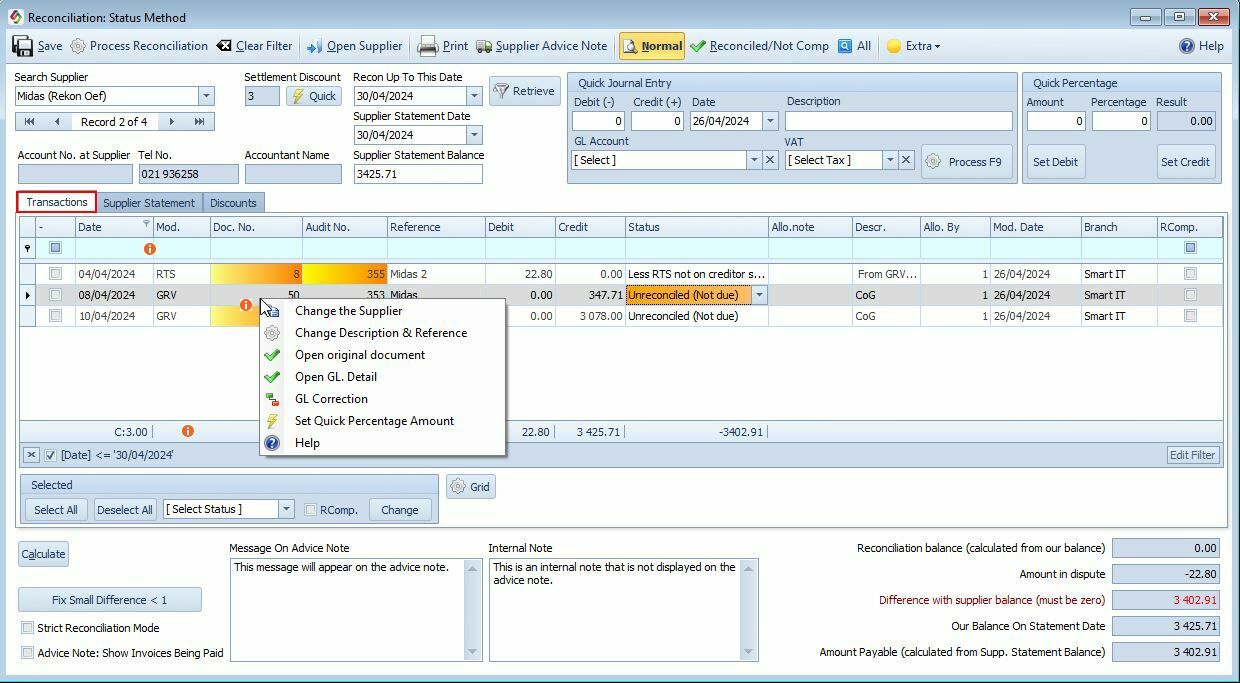

Key Supplier Reconciliation Features (Buttons on the Menu Bar) |

|

Save |

Save progress |

Process Reconciliation |

Click Process Reconciliation Finalizes the reconciliation process: •Marks the entries as completed •Transfers the data to the Completed Reconciliation table •Should only be clicked when everything is reconciled and the difference with the supplier balance is zero

|

Print the data. |

|

Clear Filter |

Remove filters. |

Open Supplier |

Open the main Supplier Form.

|

Supplier Advice Note (Remittance Advice) |

Print or email remittance advice

|

Views |

Show Normal – only non-reconciled entries (default) Reconciled / Not Completed – shows reconciled but not finalized All – shows everything, including completed items

|

Important Settings

|

|||||||||||||||||

Settlement Discount & Amount |

•The Settlement Discount % is pulled from the Supplier Form. •The Settlement Discount Amount is calculated based on the Amount Payable. •You can manually adjust the discount amount if needed. • |

||||||||||||||||

Make Settlement Discount Entry |

When you post the settlement discount: •An entry is created in the Supplier Reconciliation Form •It is marked as "Less: Discount not on statement" Journal Entries Example:

Note: If you prefer not to use the "Discount from Creditors" account, you can configure your own account under: Account Options > Account Defaults tab

|

||||||||||||||||

Supplier Statement Balance |

Enter the Supplier Statement Balance shown on the supplier's statement. It helps identify any differences or discrepancies between your calculated balance and the supplier's statement.

|

||||||||||||||||

Reconcile Up To This Date |

Reconcile Up To This Date Enter the cut-off date for reconciliation. Usually, this matches the Supplier Statement Date, unless your GRN date differs from the supplier's document date.

|

||||||||||||||||

Supplier Statement Date |

This is the date on the supplier's actual statement.

|

||||||||||||||||

Retrieve |

Click Retrieve to display only entries up to the specified statement date.

|

||||||||||||||||

Supplier Columns Explained |

|

Date |

Purchase Date |

Mod. |

Module where the transaction came from. [GRV= Goods Received, SJ = Supplier Journal, SPAY = Supplier Payment, RTS = Return to Supplier]

|

Doc. No. |

Internal document number. Click to retrieve the original document.

|

Audit No. |

Click to show the journal entries.

|

Reference |

Suppliers document reference

|

Debit |

Debits is Payments and Credits received.

|

Credit |

Amounts you owe.

|

Status (Reconciliation) |

For each entry, choose the relevant Reconciliation Status from the dropdown box. (See options below)

|

Allocation Note |

Note about the allocation.

|

Allocation By |

Employee who did the allocation.

|

Modify Date |

Date it was modified.

|

RComp |

Completed reconciliations. Will be checked automatically after you have processed the reconciliation. Strict Reconciliation mode will prevent you from changing the RComp. status. You almost never need to change the status and indicates serious problems.

|

Reconciliation Status Explained |

|

Reconciled |

Select if the amount corresponds to the amount on the supplier statement

|

Less payments not credited on statement |

Select if your payment does not show on the supplier statement |

Pay the RTS (Return to Supplier) |

Select if you do not want to deduct the RTS amount from the amount payable, thus paying the supplier

|

Do Not Pay the RTS |

If you want to subtract the RTS amount, thus not paying the Supplier.

|

Less outstanding invoice |

If you do not want to pay invoice

|

Less goods not received |

If you do not want to pay invoice

|

Minus invoices not due know |

If you do not want to pay invoice

|

If you do not want to pay invoice |

If the entries are not applicable for this reconciliation.

|

|

|

Strict Reconciliation Mode |

✅ Strict Reconciliation Mode (recommended) Prevents incorrect reconciliations Ensures accuracy: difference must be zero before processing Blocks the printing of a remittance advice unless the reconciliation is correct

❖Locking the Setting To avoid accidental deactivation, use Security Setup to restrict access to this checkbox.

|

Mark everything as reconciled up to: "Recon Up To this Date" |

Useful if you want to mark all prior entries as reconciled and start fresh. |

Fix Small Difference < 1 |

If the difference is smaller than R1 then you can select the Fix Small Difference < 1 button to automatically do a journal entry for the difference. |

|

|

Reconciliation Balance (Calculated from our balance).

|

Reconciliation Balance (Calculated from Your Balance) The Reconciliation Balance represents what your system believes is payable to the supplier, based on all transactions up to the reconciliation date.

How It's CalculatedThere are two ways to understand the formula:

Method 1: Reconciliation Balance = All credit amounts for the period (Unreconciled or Not Due is ignored) ➕ Less Outstanding Invoices ➕ Less Goods Not Received (GRNs not matched) ➕ Minus Invoices Not Due Now ➖ Do Not Pay the RTS

Method 2 (Simplified View): Recon Balance = Our Balance ➖ Unreconciled Credits ➕ Unreconciled Debits (or Do Not Pay RTS) ➕ All less or minus credit amounts

Note: The goal of the reconciliation is for your calculated Reconciliation Balance to match the Supplier’s Statement Balance. Any difference should be investigated before processing.

|

Amount in Dispute = |

Less Outstanding Invoices + Less Goods Not Received + Minus Invoices Not Due - Do Not Pay the RTS.

|

Difference with supplier balance |

Supplier Statement Balance - Recon Balance (calculated from our balance) + Amount in Dispute. If everything is correct the difference must be 0. Please Note: The difference with supplier balance must be zero. If not, find and correct the fault. If the difference is smaller than R1 then you can select the Fix Small Difference < 1 button to automatically do a journal entry for the difference.

|

Our Balance on Statement Date |

Is the sum of all credits minus all debits (completed and non-completed values). If you want to compare the value on the grid with Our Balance on Statement Date, click the All button on the menu.

|

Amount Payable |

Is the amount you must pay the supplier, also the amount used to calculate the Discount Amount. = Supplier Balance - Less Payments Not Credited On Statement or Do Not Pay The RTS |

Notes:

There should be no unreconciled entries in the reconciliation form. Change the statement date to exclude items that are not applicable for this period.

Handling a Supplier Invoice Not Received.

Option 1: Adjust the Supplier Statement Balance

•Manually reduce the Supplier Statement Balance by the missing invoice amount.

•Use the “Message on Advice Note” field to document this change for clarity and audit purposes.

Option 2: Use a Supplier Journal

•Create a Supplier Journal for the missing invoice.

•Mark the journal as “Less Goods Not Received” so the system excludes it from the payable balance until it’s received.

Access Control & Security Settings

To restrict access to specific fields or actions within the reconciliation process, use the Security Setup feature.

For example:

•Prevent users from changing the reconciliation status

•Lock down the Strict Reconciliation Mode setting