Credit Note |

Top Previous Next |

Watch the video: Credit Notes - Tutorial

Hover the mouse over the different menu options. If the cursor changes to a hand (![]() ), then click to go to the subject.

), then click to go to the subject.

Credit Note Creation Methods

There are three methods to create a credit note.

1. Create Credit Note from an Existing Invoice

Go to Invoice > Invoice Lookup. Search for the invoice you wish to credit, right-click on the invoice, and select "New Credit Note for this Invoice.".

With this method, pricing cannot be changed. Quantities cannot exceed those on the original invoice. No additional items can be added to the credit note.

This method is the most accurate to prevent mistakes and ensure that only items from the original invoice are credited.

2. Create a Credit Note Without an Associated Invoice

Go to Invoice > New Credit Note. If there is no associated invoice, use this option.

You can adjust pricing, add items, and more using this technique.

3. Create Credit Note with Existing Invoice Data

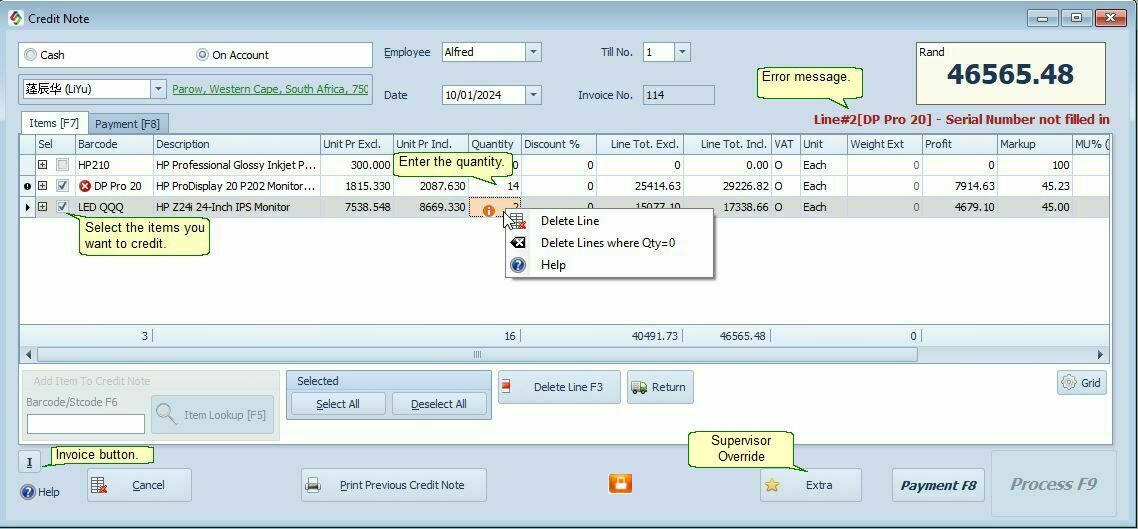

Go to Invoice > New Credit Note and select "I" (Invoice button, left bottom corner of image). This action will retrieve the invoice data directly into the New Credit Note. See image below, left bottom of form.

This method allows you to change the pricing and quantities, however no new item(s) can be added.

The credit note form will now open:

Selecting Items and Processing Credit Notes

1. Select the Items to Credit:

•Check the checkbox next to the items you want to credit.

•Be aware that the same item cannot be credited twice.

•If an item has already been credited, the Payment (F8) and Process (F9) buttons will be disabled, preventing further processing of the credit note.

2. After Selecting Stock Items:

•Once you have selected the stock items, click the Payment button.

•This step is only required if payment was recorded on the original invoice or when creating a New Credit Note and the client is due a refund.

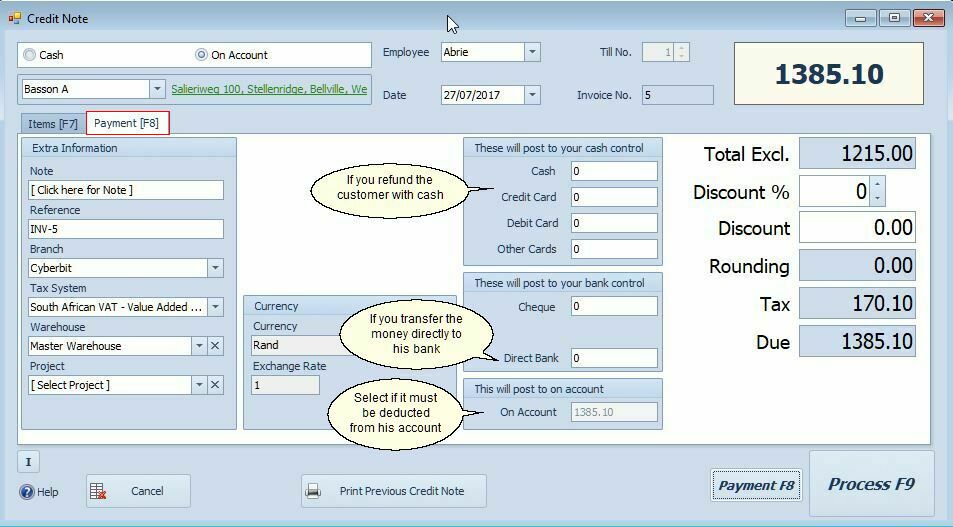

•The Payment screen will appear.

Payment Options in the Credit Note

•Cash

•If you are giving cash back, use the Cash field. Your Cash Up amount will be reduced.

•Credit Card

•If you are swiping his credit card, use the Credit Card field - your Cash Up amount will be reduced.

•EFT

•If you are paying him via Cheque or EFT, use the cheque field - your cash up will not be effected.

•On Account

•Select the On Account field if the refund should be deducted from customer's account.

Corrections for Credit Notes

Scenario 1: Incorrectly Filled Amount under Cash

If the amount is incorrectly entered under the Cash field, the following journal entries will be made: Debit Sales and Credit Cash Control

To reverse this credit note:

•Option 1:

1.Create a new invoice (either Cash or On Account).

2.Enter the correct amount under the Cash field.

3.Redo the credit note.

•This invoice will contra (cancel) the incorrect credit note.

•Option 2:

1.Create a Customer Journal.

2.Use the Cash Control general ledger account.

3.Enter the amount in the credit column.

•Option 3:

1.Go to Ledger > Corrections delete the credit note and redo it..

Scenario 2: Incorrectly Filled Amount under Cheque or Direct Bank

If the amount is incorrectly entered under the Cheque or Direct Bank field, the following journal entries will be made: Debit Sales and Credit Bank, no effect on your Cash Up

To reverse this credit note:

Option 1

Create a new invoice, enter the amount under the cheque field, redo the credit note.

Option 2

Do a Customer Journal. The General Ledger Account is Bank Enter the amount in the credit column.

Notes:

Trade-In Item: If the item is a trade-in item (e.g., an empty coke bottle), the journal entries will be opposite to those of a normal item. Stock and Input VAT will be credited and Customer Control will be debited

A credit note has no effect on the average cost price of an item.

To retrieve archived credit notes use the Credit Note Lookup. Search for the credit note and double-click on the row to open the credit note.