Stock Take |

Top Previous Next |

Stock-taking or inventory checking is the physical verification of the quantities and condition of items held in an inventory or warehouse. This may be done to provide an audit of existing stock valuation. It is also the source of stock discrepancy information.

Stock-taking may be performed as an intensive annual check or may be done continuously by means of a cycle count.

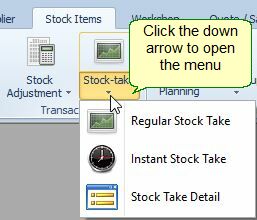

Go to Stock Items > Stock Take and select between Regular Stock Take and Instant Stock Take

Please reconcile your inventory value in the general ledger account (balance sheet value) with the actual inventory value (book value) listed on the stock take report, on a regular basis.

If there is a discrepancy between the two values, the following journal entries should be made.

If the stock take report value is greater than the balance sheet value, post the difference of the value to these accounts:

Debit Inventory and Credit Cost of Sales (or as advised by your accountant)

If the stock take report value is less than the balance sheet value, post the difference of the value to these accounts:

Debit Cost of Sales and Credit Inventory (or as advised by your accountant)

To automatically bring your Stock Account value in alignment with your Stock Value, go to the Dashboard and click on the Fix StMaster/GlDetail Value Diff. button.

These differences can occur when :

1) negative stock is allowed (selling items before you do the GRN).

2) if the Supplier list price is used instead of Average Purchase Cost, as your Cost of Sales/Valuation Method on your Main Stock Form.

3) if there is an average cost value specified for Service Items like labour and the Service Item is used as part of a Bill of Material.

Example 1

A BOM (Bill of Material) is created where labour with an average cost of $100 is included. After you manufactured the item your item will now include the $100, thus your stock value will go up with a $100 and no entries would have been made in your General Ledger.

If you amend this, the General Ledger entries will be:

Debit the Stock Account with $100 and Credit the Cost of Sales Account with $100.

If you sell the BOM item the entries will be:

Credit the Stock Account with $100 and Debit the Cost of Sales account with $100. Your general ledger stock account will now be in alignment with your Stock value.

Example 2. (using the Average Purchase Cost as the Cost of Sales value)

Your stock quantity on an item is 0 and the average cost of the item is $0 because a GRN was not generated for this item, the item is then sold, the quantity on hand will reflect -1

No entries will be made in the general ledger stock account and the cost of sales account because the items average purchase cost was zero.

If a GRN had been generated prior to selling the item, the average cost would have been reflected.

Stock value (Average Cost * In Stock): $0.00 (0 x -1 = 0)

Stock Value in the General Ledger: $0.00

Stock Value Difference: $0.00

If a GRN is generated after the sale - the journal entries will be,

Debit |

Credit |

|

Supplier Control |

|

100.00 |

Stock |

100.00 |

|

Your Stock value will be zero, quantity -1(from the invoice) + 1 (GRN) will equal 0.

Stock value (Average Cost * In Stock): $0.00 (100 x 0=0)

Stock Value in the General Ledger: $100.00

Stock Value Difference: -$100.00

You will now have to bring the general ledger stock amount in alignment with your stock value by crediting your general ledger stock account with $100 and debiting your cost of sales account.

Example 3. (using the Supplier List Price as the Cost of Sales value)

The stock quantity of an item is 0 and the Suppliers' List Price of the item is $80.

The item is then sold, the quantity on hand will reflect -1

The General Ledger entries will be as follows:

Debit |

Credit |

|

Cost of Sales |

80.00 |

|

Stock |

|

80.00 |

Stock value (Average Cost * In Stock): $0.00

Stock Value in the General Ledger: -$80.00

Stock Value Difference $80.00

Please note:

1) that the correct procedure would have been to do a Goods Received Note before you had sold the item. You can also prevent the selling of negative stock by disallowing it in the Stock/Inventory options form.

2) You can't bring the General Ledger amount in alignment with your stock value at this stage, you must wait for the GRN to be processed before you do it.

If a GRN is now done afterwards, and say the real cost of the item is $100 (remember the computer used the Supplier List Price of $80.00).

The General Ledger entries will be as follows:

Debit |

Credit |

|

Supplier Control |

|

100.00 |

Stock |

100.00 |

|

Your Stock value will be zero, quantity -1(from the invoice) + 1 (GRN) will equal 0.

Stock value (Average Cost * In Stock): $0.00 (100 x 0=0)

Stock Value in the General Ledger: -$20.00 (80 - 100 = -20)

Stock Value Difference: -$20.00

You will now have to bring the General Ledger stock amount in alignment with your stock value by debiting your general ledger stock account with $20.00 and crediting your cost of sales account.

If the Supplier List was the same as the average cost then you did not have to do anything.

Note - If you want a total inventory value (stock value), Select the Cost Price and Only where On Hand not 0. Each items' extended cost price (Qty * Cost Price) will be displayed as well as the total stock value on the last page.

You can also get a inventory value from the Extended Stock Look-up.

If you want a value per Stock Group, Check the Group By Stock Group checkbox on the Stock Take form.

You can also use this form to scan in your opening quantities. Please note you can't put in your average cost values on this form.

Remember to change the general ledger account from Stock Adjustment to an Opening Balance Account.

Use the stock adjustment form to add average cost values or you can import your average cost and inventory items from the CSV Import form. Go to Stock | Stock Extra | CSV Import / Export

For complete details see Taking on Inventory Balances