Reconcile your bank per hand |

Top Previous |

Reconcile your bank per hand from the general ledger detail. (see also bank reconciliation)

Should you need to explain the difference between the bank balance in your general ledger and the balance on your bank statement.

[If you printed your Unreconciled Report, on the bank reconciliation form, after you have done all of your bank entries for the year, and before you continue reconciling the next year, then this step wouldn't be necessary].

1) Get the bank balance from your general ledger by doing an enquiry or from your trial balance on that specific date, for example -R48405 (credit).

2) Get the bank balance from your bank statement, for example -R6022.91 (credit)

The difference between your bank balance and the bank statement is R42382.09 (48405-6022.91). You now want to get a list of a all the amounts that were outstanding on the 28th of February.

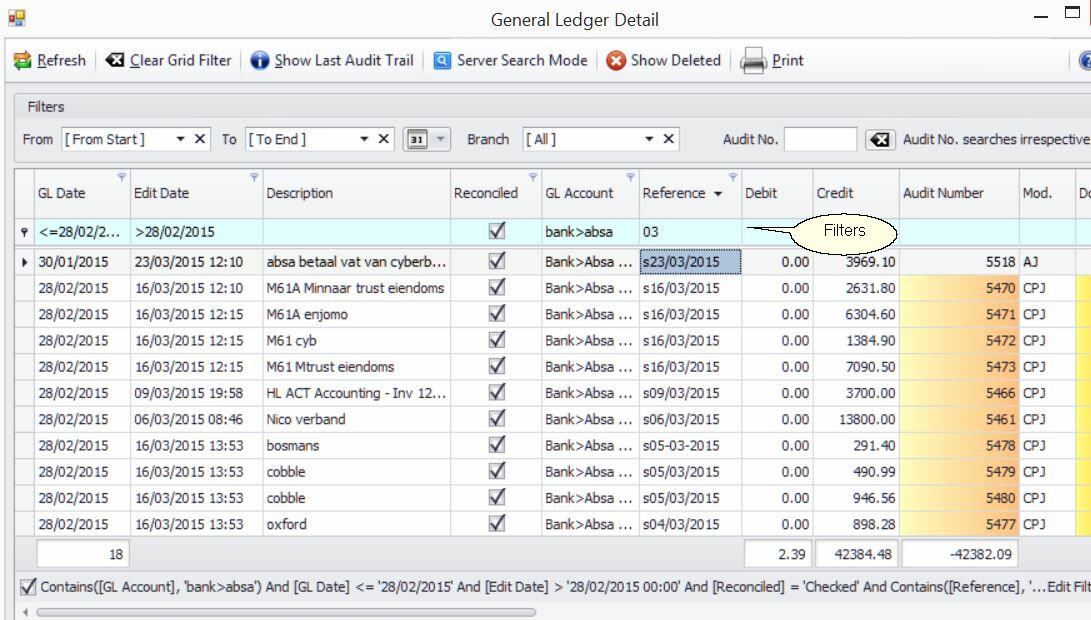

Go to Leger > GL Details and filter your form. See image below.

Setting up the filters as in the image above will give you a list of transactions where the GL date was before the 28th, but the actual transaction went through your bank after the 28th. Reason, maybe you back dated an entry, e.g. you received the telephone bill on the 15th of March and paid it on the 15th but you still want to book it in the previous book year.

In the Edit Date field (actual date when the entry was made) filter for >28/02/15 and in the reference field for 03 ( the 03 is the month) and all entries already reconciled

Please note that the reference in the Reference Field for e.g. s02-03-2015 is supposed to reflect the date that is on the bank statement. If the reference is not correct, right click on the row and select Correct this entry and change the reference so that the reference is the same as the date on the bank statement.

All these transactions were supposed to be unreconciled on the 28th. In the image above the amount is R42382.09 which corresponds to the amount that you must explain (48405-6022.91).