Employee: Deductions & Earnings (Pay Slips) |

Top Previous Next |

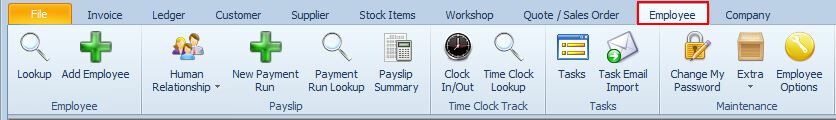

Go to Employee and select the Deductions and Earnings tab

![]()

Employee Deductions and Earnings

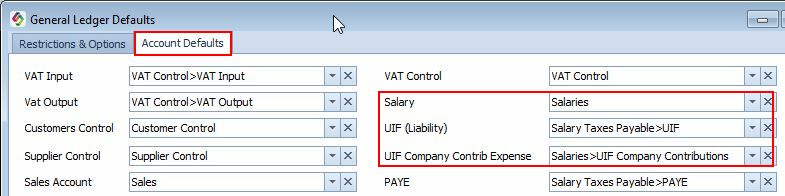

Setup your accounts and account defaults.

Step 1.

Go to Ledger > Account Setup and add all employees as sub accounts of the main general ledger account, Salaries.

Go to Ledger > Account Options and select the Account Defaults tab. Select your Salary, UIF and LBS general ledger accounts. See below.

Step 2.

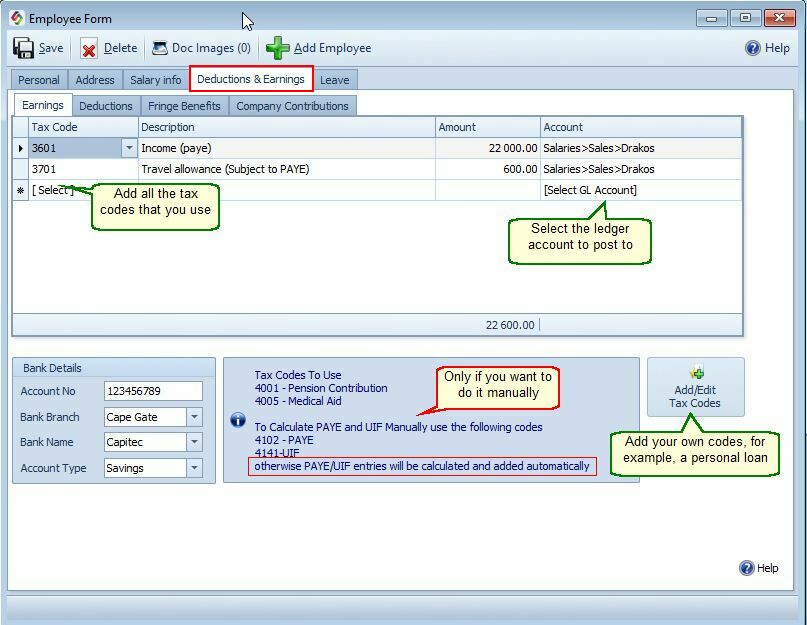

Go to Employee > Lookup and open the employee you wish to edit. Right-click on the employee and then select the Deductions & Earnings tab.

Fill in only fixed deductions and earnings. Data that changes every month like commissions can be filled in, in the New Payment Run form.

Hover the mouse over the different menu options. If the cursor changes to a hand (![]() ), then click to go to the subject.

), then click to go to the subject.

Step 3.

Go to Employee > New Payment Run to process your salaries.