Ledger > Financial Statements: Statements Over Time |

Top Previous Next |

Hover the mouse over the different menu options. If the cursor changes to a hand (![]() ), then click to go to the subject.

), then click to go to the subject.

![]()

![]()

![]() Financial Statements Over Time

Financial Statements Over Time

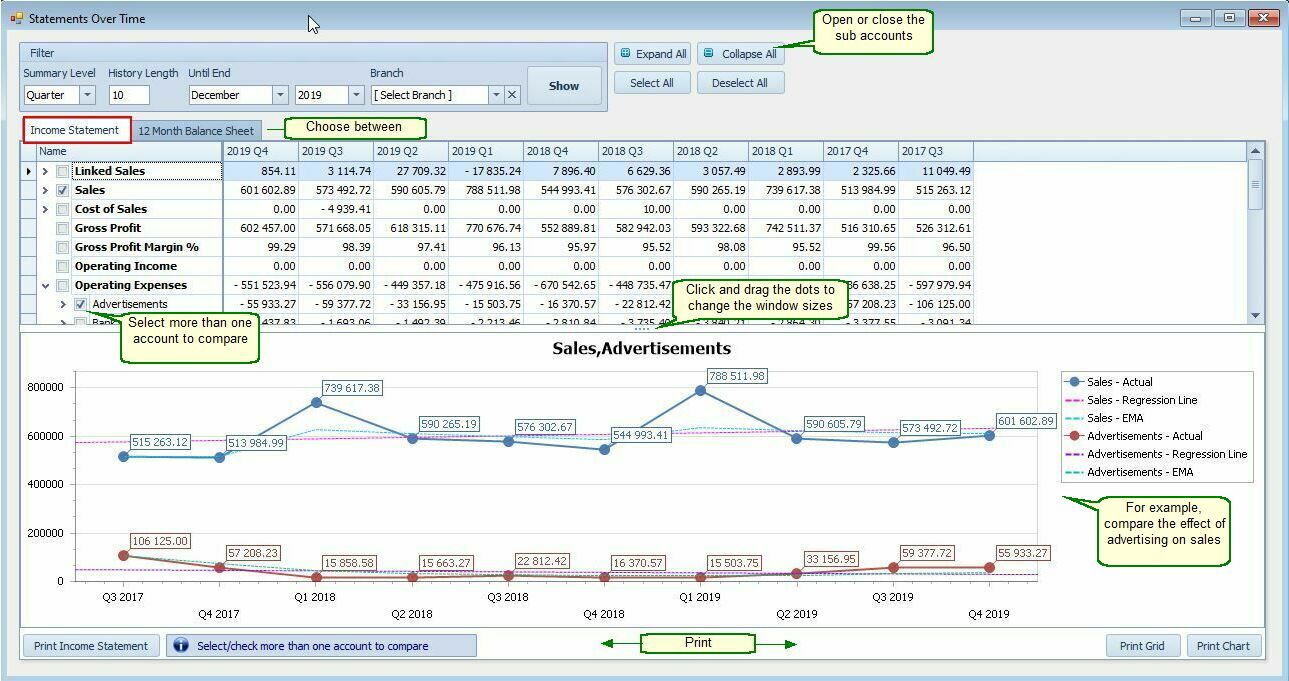

Financial Statements Over Time allows you to analyze a company’s financial performance across multiple time periods (monthly, quarterly, annually, or weekly). This helps in identifying trends, patterns, and changes in financial position over time.

Go To: Ledger > Statements > Statements Over Time.

Customization Options.

Customization Options.

Field |

Description |

Summary Levels |

Choose to summarize data by Month, Quarter, Year, or Week.

|

History Length |

Set the number of periods (e.g., 24 Months, 12 Quarters).

|

Until End |

Select the end date for the report (e.g., July 2025). The system will work backward from this date.

|

Branch |

Choose which branch’s data to include. |

![]() Features:

Features:

•Generate reports for:

•Income Statement

•Balance Sheet

•Trial Balance (mix income and balance sheet items in one report)

•Compare Multiple Accounts:

•Combine multiple accounts into a single graph for side-by-side analysis.

Example: View Sales and Inventory trends on one chart.

•Branch Flexibility:

Work with individual branches or generate consolidated reports across multiple branches.

Period Comparison:

•✅ View results side by side across multiple periods.

•Use Month, Quarter, Year, or Week as the summary level—each with customizable period lengths.

•User-defined date range: Not limited to fixed financial periods; you can start and end on any date.

![]() Notes

Notes

•Export formats: PDF, XLS, XLSX, HTML, MHT, CSV, or image file.

•Multi-level reporting: Up to 3 levels deep — e.g., parent accounts with sub-accounts.

•Drill-down capabilities: Right-click any account to open the Account Enquiry form with individual journal entries.

•Flexible display: View in tabular or graphical format, and resize the window to fit your screen and workflow.

•Pivot Grid Option:

•If you need more flexibility, use the Pivot Grid.

•It allows you to drag, drop, and group data by various dimensions such as account, period, or branch — making it easy to customize your own summary views and identify patterns quickly.

•Trends

To help you identify trends, there are 2 techniques, namely linear regression and an exponential moving average (EMA) lines on the chart. - EMA gives more weight to recent data, helping you spot turning points or sustained trends.

Why Use EMA in Smart-IT?

Smoother Trend Lines: Reduces noise from short-term fluctuations.

Better Forecasting: Helps anticipate future performance based on recent momentum.

Visual Clarity: Makes it easier to present financial trends to stakeholders.

Would you like a visual mock-up of how Smart-IT’s EMA graph might look, or a guide comparing EMA vs. simple moving average in financial reporting?

![]() Use Case

Use Case

Ideal for managers, analysts, and accountants who want to:

•Track financial health over time.

•Compare revenue and expenses side by side.

•Forecast based on historical performance.