Ledger: Bank Reconciliation |

Top Previous Next |

Go to Ledger > Bank Reconciliation

Hover the mouse over the different menu options. If the cursor changes to a hand (![]() ), then click to go to the subject.

), then click to go to the subject.

![]()

![]()

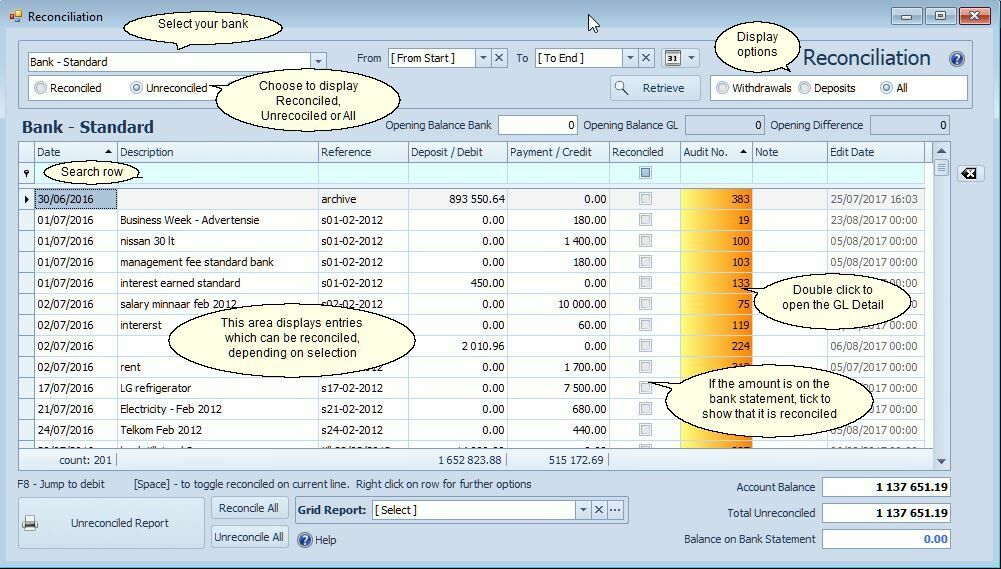

Bank Reconciliation

Purpose: Displays bank details for every deposit, withdrawal, and bank fee for a selected bank account.

Definition: Bank reconciliation is the process of matching the balance in an organization’s bank statement with the corresponding balance in its accounting records. This helps identify discrepancies and ensures accurate financial reporting..

See also: Ledger > Bank Manger for automatic bank reconciliation.

Select Account to Reconcile: Only accounts that is marked as Reconcilable in the General Ledger Accounts Setup will be available for selection.

Bank Reconciliation Fields Explained |

|

Select Account to Reconcile |

Only accounts that is marked as Reconcilable in the General Ledger Accounts Setup will display here. |

Select between (top of the form) |

Reconciled: Displays already reconciled transactions. Unreconciled: Displays all transactions that you still need to reconcile. All: Displays both reconciled and unreconciled transactions. |

From date To date |

These fields are primarily used for troubleshooting. For example, if the 'Balance on Bank Statement' differs from the actual statement, you can use the date range to identify the date on which the error occurred.

1. Calculate the difference between the 'Balance on Bank Statement' and the actual bank statement. 2. Move the From Date backwards till there is an Opening Difference (Opening Balance Bank and Opening Balance GL differ).

If for example the difference appears for the first time on the 4th then you know that the problem must be on the 3rd 3. Now, show all the transactions from the 3rd and look for the difference. The difference could be a combination of more than one amount, that you calculated in Step 1

|

Retrieve button |

Will remove all the checked transactions. If a date range was specified it will retrieve the data.

|

Unreconciled Report |

To print all unreconciled transactions, click on the Unreconciled Report button. This report tells you which transactions were not reconciled. This report is useful if you have trouble reconciling next month. Each time you reconcile, the previous month's reconcile report is overwritten with the new one. So, if you want to save a record of this reconcile report, either print a copy, or save it by printing to a file. Please print it regularly and especially at year end for auditing purposes. Note - At year-end Please remember to print your Unreconciled Report after you had made all your bank entries for the year and before you went on with reconciling the next year. If for example your year end is on the 28th of February then the Balance on Statement as displayed on the Unreconciled Report must be the same as on your bank statement. For in case you forgot to print the Unreconciled Report - see below Reconcile your bank per hand ...

|

Account Balance |

General Ledger account balance. |

Total Unreconciled |

Sum of all the unreconciled transactions. |

Balance on Bank Statement |

The difference between the Account Balance and Total Unreconciled amounts. This balance must exactly match the balance shown on your bank statement. |

Marking Transactions as Cleared

When a transaction matches one on your bank statement, check the corresponding checkbox to mark it as cleared. The Balance on Bank Statement will update immediately to reflect the new total. This balance must match the balance on your bank statement. Compare the amount immediately against the bank statement. If the difference is not zero, investigate and correct any discrepancies before proceeding.

Handling Missing Transactions

If a transaction appears on your bank statement but is missing from the Reconcile screen, enter it before continuing with reconciliation.

To view previously reconciled transactions, select ![]() . If needed, you can deselect a transaction to un-reconcile it.

. If needed, you can deselect a transaction to un-reconcile it.

Reconcile your bank per hand from the general ledger detail.

Should you need to explain the difference between the bank balance in your general ledger and the balance on your bank statement.

[If you printed your Unreconciled Report, on the bank reconciliation form, after you have done all of your bank entries for the year, and before you continue reconciling the next year, then this step wouldn't be necessary].

1. Get the bank balance from your general ledger

•Perform an enquiry or check your trial balance for the specific date.

•Example: -R48,405 (credit).

2. Get the bank balance from your bank statement

•Check your bank statement for the same date.

•Example: -R6,022.91 (credit).

3. Calculate the Difference

•The difference between your General Ledger balance and bank statement balance is:

R48,405 - R6,022.91 = R42,382.09

•This is the amount you need to reconcile.

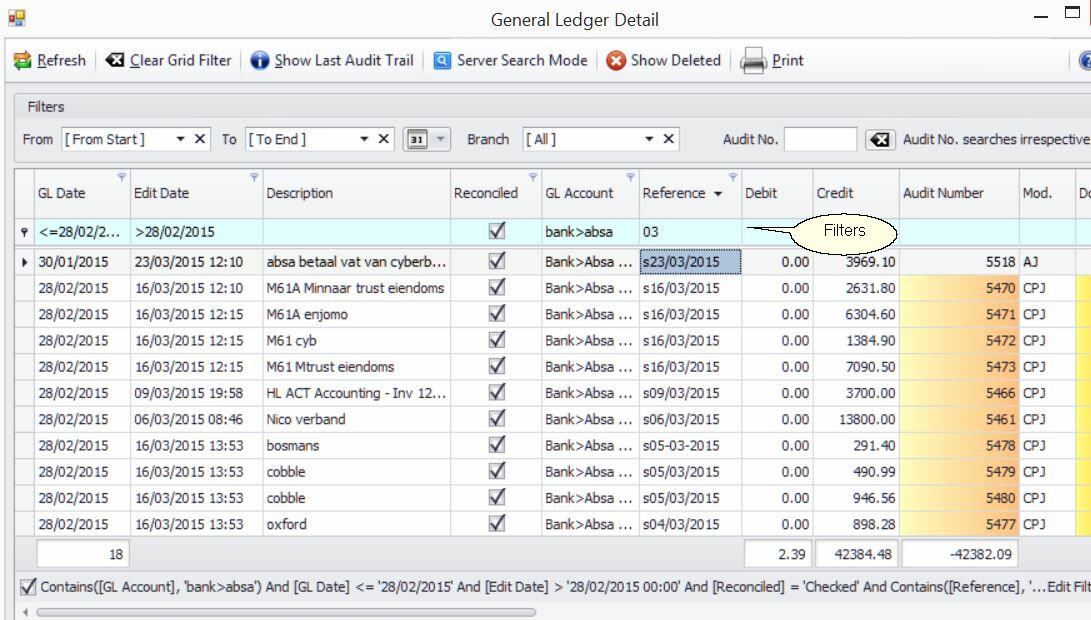

Go to Leger > GL Details and filter your form. See image below.

Generating a List of Outstanding Transactions (As of February 28th)

1.Go to: Ledger > GL Details

2.Apply the following filters (see image below: [PICTURE Rekon_from_Gl2.jpg]):

•GL Date: Before February 28th

•Edit Date: After February 28th (e.g., >28/02/15)

•Reference Field: "03" (for transactions from March)

•Reconciled Transactions Only

Why This is Useful

This method helps you identify transactions that were:

•Recorded in the previous fiscal year but processed by the bank in the new fiscal year.

•Backdated transactions, such as a March 15th telephone bill that was paid on March 15th but booked in the previous year.

Correcting Reference Dates

The Reference Field (e.g., S02-03-2015) should match the date on the bank statement.

If incorrect, right-click the row, select Correct this entry, and update the reference to reflect the actual bank statement date.

Final Verification

All these transactions should have been unreconciled as of February 28th.

In the example, the total outstanding amount is R42,382.09, which corresponds to the discrepancy (48,405 - 6,022.91)